Get Our Free Guide to Success with a New Insurance ProgramSeptember 15, 2023

Creating an insurance program to offer new, in-demand coverage options can be a big growth opportunity for your business - if you do it right. If you don’t, however, it can be an expensive, time-consuming misstep. This guide aims to help you do it right. Download How to Succeed with a New Insurance Program To create this guide, we tapped into some of the most experienced insurance experts we know: our own internal team. The Boost team has built 9+ products since 2018, and before that our experts led groups at some of the biggest names in the industry. We got their advice on how to determine if a new insurance program is the right opportunity for your business, and if so, how to set yourself up for success: What to Know Before You Start covers the growth opportunity of insurance, and the most common pitfalls that we’ve seen businesses fall into. The Foundation for Success outlines the most important pieces to have in place before starting work on a new insurance program. Elements of a Successful Program discusses the areas that we’ve seen the most successful insurance programs take the time to get right. The Insurance Program Build Process explains what’s involved in actually building the new program, including timeline and budget estimations. Already know that a new insurance program is right for you? Learn more about the next steps in the development process with How to Build an Insurance Program: A Guide for Insurtechs

Continue Reading Is Building an Insurance Product Right For Your Business?August 25, 2023

Insurance is a hot market right now, and there’s a lot of interest in developing innovative new insurance products. But is it the right opportunity for your business? Maybe your business already sells insurance, and you’re thinking of going after a new market segment with an unmet need. Maybe you’re in a complementary business, and considering if a new type of insurance product could help grow your revenue. Either way, creating a new insurance product (and the program needed to support it) is no small task. Here’s a few things to think about as you decide if developing a new insurance product is a good fit for your business. It’s no wonder you’re considering developing a new product: in many ways, the timing has never been better. The insurance market is particularly ripe for new entries, and the rewards for success are high. Insurance revenue compounds as you grow. Insurance revenue is recurring revenue. Your customers pay their premium amount for as long as their policy is active, and that can add up quickly as you add more customers. Once a product picks up momentum in the market, its revenue growth can rapidly start to multiply as new policyholders’ premiums are layered over existing ones. The P&C insurance market is huge. The U.S. property and casualty insurance market wrote more than $775B in premiums in 2022 - a 25% increase over the last 5 years. Put frankly, there’s a lot of money to be made in the insurance market, and the overall pie just keeps getting bigger. Creating new product has the potential to increase that even further by reaching previously unavailable customer segments. Many existing products are behind the times. Now, there are some excellent products in the insurance market today…but there are also a significant number that haven’t been updated in years (or decades). Older products that might have been a good value when they were first built often don’t match the needs of today’s buyers. For businesses that can offer new, modern products built for current risks, there’s a big opening to fill in the market. While we’ve seen the opportunity is a big one, building a new insurance product to take advantage of that opportunity is not a simple undertaking. There are several very real challenges that can catch businesses by surprise, and derail their new product development plans. It requires patience, and a willingness to invest. Even with the best partners to help you, building a new insurance program is costly, and takes at least six months (and if you plan to build it from scratch in-house, it can easily take two or more years). The payoff can be totally worth it, but businesses that expect the build process to be fast and easy often don’t make it to the finish line. The regulatory requirements are complex. It’s no secret that insurance is heavily regulated. There are already a number of rules around selling insurance (that vary between states), and doubly so for building a new product. Paying close attention to all compliance and licensing requirements, in every state you intend to sell in, is critical to success. New products are a higher GTM lift than existing ones. In any industry, first-of-their-kind products need more go-to-market resources than products the audience is already familiar with. If your product is aimed at a currently-unmet market need, you should plan for a period of educating your potential customers on what the product does and how it can help them. Expecting a new product to immediately achieve big market traction can lead to disappointment (this actually ties back to our first point - patience is a must!). While the challenges to building a new insurance product shouldn’t be taken lightly, they’re also very manageable with the right approach. The key is to lay the foundation for your initiative, before you kick it off. Your business needs to take the long view. As we’ve discussed, a new product can be very lucrative, but it’s not likely to yield fast-turnaround profit. Businesses with successful new insurance program launches have a long-term vision for how the new product will grow and build revenue. You need a business plan, and an owner for it. Like any other product, you’ll need to support your new insurance product with GTM resources, determine its business goals, and measure its performance. This is most likely to be successful with an internal owner who is accountable for getting the product to market, and later meeting the program targets. Your executive team needs to be on board. The bottom line in all this is really that the process of building a new insurance product requires business planning, cross-functional support, and non-trivial resourcing…which means you’ll need your executives’ support. Successful initiatives for building a new insurance program generally have one or more executive sponsors, who champion the initiative, help ensure it stays on track, and hold responsibility for its outcomes. If your new product initiative doesn’t have that, on the other hand, it’ll be unlikely to get off the ground at all. A new insurance product can help drive a lot of revenue and growth for your business, but it won’t happen overnight. As you decide if a new product is the right opportunity for your business, it’s important to carefully consider your business goals, the challenges involved, and how to put in place the foundation for success. Decided that building a new insurance program is the right choice for your business? Boost can help. Contact us to get started today.

Continue Reading How it Works to Develop a New Insurance Product with BoostSeptember 2, 2023

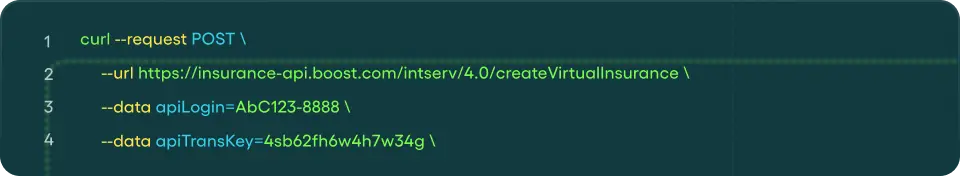

If you’ve visited our website, you’ve probably seen that Boost is a full-stack digital insurance platform that’s built for growth. Our API-driven infrastructure makes it easy to build and sell innovative, customized insurance solutions. But what exactly does that mean? And what exactly does it look like to build a product with Boost? In this blog, we'll break it down step-by-step and explain the three phases of new insurance product development with Boost, all the way from the drawing board to your successful launch. The first phase of working with Boost to build a new insurance product is all about laying the groundwork for the new program. It’s a very collaborative and research-heavy phase with the goal of creating a well-rounded product proposal. The first step is to meet with our team to discuss your idea, and how it might fit into the market. Our insurance experts will help evaluate the opportunity for a new insurance product, and decide if it’s the right fit for your business and ours. Our team will then start researching the market, looking at areas like the regulatory environment, market size, and how the product might be structured. From there, we’ll put together an initial scope of what the product might cover (and what it won’t). With this information in hand, Boost will create a product sketch—a conceptual representation of the program's key elements. The product sketch is then reviewed by your key stakeholders, including insurance experts, actuaries, members of your C-suite, etc. This is your opportunity to review all of the essential details, give positive and constructive feedback, request adjustments, and ask any questions that you might have. Our experts will then take your feedback and make any necessary adjustments to ensure that the program aligns with your vision, our scope, and the target market's needs and preferences. Once everyone is happy with the proposal and the product sketch receives final approval, product development can begin! This is where the product begins to take shape. The first step is organization. Our team builds a detailed product development timeline that outlines every step and milestone from conception to launch. This timeline acts as a roadmap, guiding the team through the development process. Our team starts by developing the documentation that will be used to provide insurance coverage under the program. This stage includes: A crucial step of the insurance product development process is to submit the program details to our reinsurance and fronting carriers. Securing capacity is a hugely important aspect of creating a program, and can be one of the most challenging areas for insurtechs trying to launch new products. A great aspect of working with Boost is that we already have a panel of dedicated reinsurance partners in place to secure and scale capacity for new insurance programs. We’ll share the program with our partners, and address any questions or concerns they may have. After our carrier partners agree to provide reinsurance backing for the new product, the next stage can begin. With our reinsurance and fronting carriers on board, the program enters the technology and product filing phase. The product will need to be filed with the insurance regulatory agency in each state where you want to sell your product. We’ll start this phase by building out a timeline for this process, including which states to prioritize. Our team then handles the task of preparing and filing the product with each state and handles any requests for change or clarification from individual state insurance departments. This is the phase where Boost’s dev team configures our state-of-the-art policy administration system (PAS) to incorporate all your new program's features and underwriting guidelines. When they’re finished, you’ll be able to access the product through a simple API integration with your own digital environment At this stage, our dev team passes the baton to your dev team to integrate the new API. Luckily, our insurance API was specifically built with developers in mind to be as smooth and easy to implement as possible. We are also there to support you through the implementation process and troubleshoot any issues and ensure a smooth experience. Once the necessary filings are approved, and the API integration is completed successfully, the program is ready for launch! You can start selling the new product to your customers and generating additional revenue. Working with Boost is a collaborative and result-oriented experience. From the initial stages of research and proposal to the final steps of technology integration and product filing, our team of experts is dedicated to bringing your next innovative insurance solution to the market. If you want to learn more about partnering with Boost to build a custom insurance product, contact us.

Continue Reading Explore Our Blog

Learn how Custom New Product is unfolding — in real time

Explore Now