What Is Cyber Insurance?April 7, 2023

In the digital age, companies rely heavily on technology to conduct their operations and manage sensitive information. However, with this reliance comes the risk of cyberattacks, data breaches, and other online threats that can have serious financial and reputational consequences. That's where cyber insurance comes in. In this blog post, we’ll explore what cyber insurance is, what it can cover, and why it has become an essential tool for managing the risks of conducting business in today's digital world. Cyber insurance is a type of insurance designed to protect individuals and businesses from internet-based risks, such as data breaches, cyberattacks, and other types of cybercrime. It typically provides coverage for expenses related to the recovery from a cyber attack, including legal fees, public relations expenses, and other costs associated with responding to the attack. Cyber insurance has become increasingly popular in recent years as the number and severity of cyber-attacks have increased, and more companies have come to rely on digital technology to conduct their business. Cybercrime is rising across the board, and every company should take steps to protect themselves. 2022 had the second-highest number of data compromises in the U.S. in a single year, and the total cost of cybercrime is predicted to hit $8 trillion by the end of 2023, and grow to $10.5 trillion by 2025. For individual businesses affected, the cost can be significant: in 2022, the average cost for a data breach in the U.S. was $9.44M. According to a Deloitte Center for Controllership poll, 34.5% of polled executives report that their companies were targeted by a cyber attack in the previous 12 months, 22% of those same executives reported that they actually experienced a cyber event, and 12.5% experienced more than one. Those are sobering statistics, but not all companies are taking the initiative to protect themselves against these crimes. According to the same Deloitte Center study, nearly half (48.8%) of C-suite and other executives expect the frequency and severity of cybercrime to continue to rise, but only 20.3% of those polled have cyber insurance. It’s recommended that all companies that operate online have some type of cyber insurance. If a company uses its website for business activities, such as storing customer information, making transactions, or communicating with clients, or if it utilizes a cloud storage service to store important data, having cyber insurance is a good safety measure. The concept of cyber insurance is not very different from any other kind of insurance product. Instead of paying exorbitant costs to recover after a disaster has occurred, a company can buy a cyber insurance policy and pay a regular, predictable premium. Then, if the company suffers a cyber incident, they can make an insurance claim to recover some or all of their losses. This kind of risk management mitigates large, unexpected expenses and helps business owners to rest easier knowing that, in the event of a cyber attack, the company will receive the financial support it needs to recover. Cyber insurance policies can vary widely depending on the provider and the level of coverage needed. They can cover losses resulting from unauthorized access to or theft of data, damage to computer systems or networks, and loss of income due to system downtime or interruption of business operations. They can also cover liability for damages caused to third parties as a result of a cyberattack. Standard cyber insurance policies generally cover things like: In the event of a breach, expenses related to investigating the breach, determining the cause of the incident, and notifying those who were impacted can rack up quickly. Not only can cyber insurance alleviate some of that financial hardship, but it can also cover expenses like monitoring the credit of affected customers, paying overtime salaries to employees who dealt with the situation, call center costs, public relations expenses, and other related costs. If a business is experiencing cyber extortion, meaning that its website data or capabilities are being held hostage for payment, this coverage might cover the cost of investigating the extortion incident, engaging in negotiations, and paying ransom demands. Whether by regulators or trade groups such as PCI, cyberattacks can sometimes result in fines or other penalties for the affected business. Insurance can cover the cost of defending a company if the breach results in a regulatory proceeding, and also the cost of potential resulting fines or penalties. A severe cyberattack can temporarily prevent the business from operating - for example, if the business is unable to access its data or process payments. Business Interruption and Restoration coverage can help to cover the cost of getting the business up and running again after a cyber incident. If a business is interrupted for longer than a certain period of time, this kind of coverage may also pay for revenue lost during that time. Other coverages, if not included in a standard cyber insurance policy, may be available as endorsements: Through phishing attacks and similar incidents, cyber criminals can gain access to accounts or credentials that allow them to initiate fraudulent bank transfers and steal businesses’ funds. This coverage reimburses victims for the lost money. Some cyberattacks can permanently disable computer systems (also called “bricking”). If a business with cyber insurance has their equipment bricked by a cyber incident, the cost of replacement may be covered by their policy. After a significant cyber incident, the business will need to repair and improve their systems to prevent similar attacks from happening again. This can include eliminating vulnerabilities, or making overall improvements to their systems. This work can be expensive, and is sometimes covered by cyber insurance. A large number of cyber attacks are enabled by social engineering, in which a scammer tricks someone at the business into sending money or sensitive information. Cyber insurance may reimburse the business for money lost if an employee falls for a scam. If scammers access the business’s telecommunications equipment and use it to run up fraudulent charges on their bill, cyber insurance may cover the amount lost.

Cyberattacks can be devastating for businesses, and the threat continues to grow every year. With the right insurance in place, however, businesses can have peace of mind knowing that even if cybercriminals strike, they’ll have the financial protection they need to get back on their feet.

If you cater to small to medium businesses and want to learn more about how you can grow your revenue by offering cyber insurance, contact us, or dive into building your insurance program with Boost Launchpad.

Continue Reading Cyber Insurance White-Labeling: How it WorksMay 5, 2023

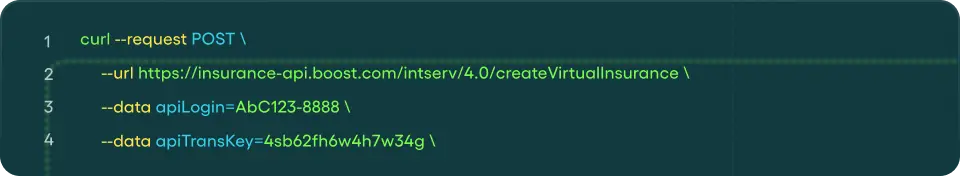

For both cybersecurity service providers and insurtechs that focus on commercial clients, adding a cyber insurance product can build significant recurring revenue for your business, and deepen your relationships with your current customers. Creating a new insurance product, however, is much more complex than a new piece of software or a physical gadget. Building an insurance program from scratch is a yearslong endeavor that requires a significant amount of capital and specialized expertise. A much faster path to market is to white-label an existing cyber insurance product, and offer it to your customers. In this article we’ll go over the process of getting to market with a white-label cyber insurance product, and the advantages of this route vs. building a new product yourself. A white-labeled product is produced by a particular company, then sold by other companies under their own brand. This is common with physical goods, particularly products sold as part of a certain store’s brand. For example, Costco offers a broad variety of goods under their Kirkland Signature label, ranging from jeans to potato chips. However, Costco doesn’t own and operate the factories and logistics chains necessary for producing hundreds of diverse items. Instead, they source products from other businesses that do manufacture those goods, and then sell them in-store under the Kirkland Signature branding. The same principle applies to white-label insurance. Insurance-as-a-service providers such as Boost have already invested the time and resources to build new insurance products, which other businesses can then offer under their own branding. This allows businesses to get to market with a new insurance offering at a much lower time and cost requirement than would be required to build a new product themselves. Once your company decides to offer white-labeled cyber insurance, there are a few steps to go through in order to get to market. The first step is choosing the insurance provider whose products you want to white-label. This could be an insurance-as-a-service provider like Boost, or possibly a traditional insurer. When selecting a partner, make sure to ask about two things: what they allow for white-labeling, and whether the product can be customized. Some insurers allow for their products to be resold, but not re-branded; others offer products as-is and don’t allow changing things like the coverage configurations. Be sure that your partner can deliver on what your business needs (and expects). You know your customers best - what they need, and what they don’t. Assuming your partner allows customization, the second step is to configure your cyber insurance product so that it’s right for your audience. There may be some coverages that are particularly important to your customers, and others that aren’t relevant to their particular business needs. In general, the more an insurance product covers, the more expensive it is. You can ensure the best value for your customers by building an insurance package that includes all the protections that they need from cyber insurance, with nothing that they don’t. If your business is an insurtech, you’ve already got this covered. If your company is new to insurance, however, you’ll need to get an insurance license to gain the full benefits of offering cyber insurance. There are multiple types of insurance licenses, and the exact requirements vary from state to state. Since insurance in the U.S. is regulated at the state level, you’ll also need a license from each state you intend to sell insurance in. However, this is less difficult than it sounds. With support from a good partner, the process can be very straightforward and relatively painless. After you’ve settled on a partner and product, you’ll need to connect your partner’s system to your digital experience to offer the product to your customer. When you work with Boost, this means leveraging our API to build an integration between your website or app and Boost’s policy administration system. If you’re not familiar, a policy administration system (PAS) is the system of record for every transaction related to an insurance policy. For digital insurance, the PAS is the technological underpinning that allows customers to buy and manage their policies online. Different PAS have different capabilities, and some are better able to support digital insurance workflows than others. This is another area where it pays to get detailed with your partner, so there are no surprises when it comes time to deploy. Once the integration is complete, you’re ready to start connecting your customers with cyber insurance. Your customers’ purchase experience can vary depending on your partner’s capabilities and business policies. Here’s how it works with Boost: your customers will be able to buy your white-labeled cyber insurance directly from your existing website or app, under your own brand. The customer can manage every part of their policy lifecycle digitally, from quote to purchase to modifications, with no offline manual processes. The cyber insurance product will be branded as your company’s product, all the way down to the logo on the policy documents. There are several upsides to offering a white-labeled cyber insurance product instead of building an entirely new cyber product just for your business to sell. The benefits include lower costs, faster time to market, and easier, more scalable operations. Building a new insurance program requires significant financial investment, particularly when it comes to expertise. Insurance is complex, and successfully creating a new product requires actuaries, underwriters, insurance regulatory attorneys, and more. Then there’s the tech side - if you want to offer your product digitally, you’ll need a PAS capable of supporting all of the necessary insurance operations. This means considerable development work, even starting with an “off the shelf” PAS. All in all, the costs of building a new insurance program from scratch typically run into the millions of dollars. White-label products have already gone through the development process, and are ready to sell digitally. While there are still development costs required to connect your partner’s PAS to your digital experience, those expenses are usually a fraction of what it would cost to create an entirely new cyber product and the digital infrastructure to sell it. While exact timing can vary, it’s safe to expect a timeline of at least three years between starting the process of creating a new insurance product, and being able to sell your first policy. There are many steps involved in building an insurance program from scratch, and some of them - like convincing a carrier to back your product - can be very difficult to accomplish for new entrants to the insurance market. Since white-label cyber insurance products are already built and ready to sell, the go-to-market timeline for offering these products is dramatically shorter. You’ll just need to sign with your partner and then build the necessary integrations, a timeline of weeks or months instead of years. Insurance programs are constrained by their capacity - the maximum amount of value a program can insure, as determined by the total amount of capital available to cover its losses. Once a program has sold as many policies as its capacity can support, it can’t sell any more until more capacity becomes available. Acquiring more capacity for an insurance program requires complex negotiations with licensed insurance or reinsurance carriers, which can take a long time. With white-label cyber insurance products, your partner will have already secured the capacity needed to sell your product, and built a network of relationships with capacity providers to ensure their programs can continue to scale. Launching your insurance offering is only the beginning. The program will need to be managed on an ongoing basis. This includes responsibilities like ensuring that it remains compliant with all relevant state regulations, maintaining and continuing development of the technology required to sell digital insurance, and managing claims from your customers (which are legally required to be handled by licensed professionals). Building your own cyber insurance product means that you’re responsible for these ongoing operational needs, and you’ll need to hire in-house resources to manage these them. If you choose to white-label, however, then your partner will be the one to manage these ongoing program requirements. This represents significant opex savings, and allows non-insurance companies to avoid a costly distraction from their core value and offerings. Cyber insurance is a big revenue opportunity for insurtechs and cybersecurity companies alike. White-label cyber insurance allows businesses to tap into that opportunity, with significantly lower barriers-to-entry than building a whole new cyber insurance product themselves. Thinking about adding cyber insurance to your offerings? Our free ebook has everything you need to know. Download The Comprehensive Guide to Offering SMB Cyber Insurance today, or get in touch with our experts to learn more.

Continue Reading Get the Guide: Offering SMB Cyber InsuranceApril 21, 2023

With cyber crime rising sharply over the past few years, it’s more important than ever for every business to protect itself with cyber insurance. For any business concerned with commercial cyber protection, offering SMB cyber insurance can be a big opportunity to grow your revenue while connecting your customers with the protection they need. The Comprehensive Guide to Offering SMB Cyber Insurance covers everything you need to know to add and SMB cyber insurance product to your lineup, including: Learn the most common cyber coverages available to businesses, as well as key differences between SMB and enterprise cyber products. Get insight into what types of businesses stand to benefit the most from the cyber insurance opportunity, and why. Weigh your options with the most common go-to-market paths for a new cyber insurance product, with detailed explanations on timelines and requirements. Get tips on how to support your cyber insurance product after launch, including actionable ideas for connecting with customers. Download the Guide

Continue Reading Explore Our Blog

Learn how SMB Commercial Cyber is unfolding — in real time

Explore Now